According to a recent survey,

more and more Americans are concerned about a possible recession. Those

concerns were validated when the Federal Reserve met and confirmed they

were strongly committed to bringing down inflation. And, in order to do

so, they’d use their tools and influence to slow down the economy.

All of this brings up many fears and questions around how it might

affect our lives, our jobs, and business overall. And one concern many

Americans have is: how will this affect the housing market? We know how economic slowdowns have impacted home prices in the past, but how could this next slowdown affect real estate and the cost of financing a home?

According to Mortgage Specialists:

“Throughout history, during a recessionary period, interest rates go up at the beginning of the recession. But in order to come out of a recession, interest rates are lowered to stimulate the economy moving forward.”

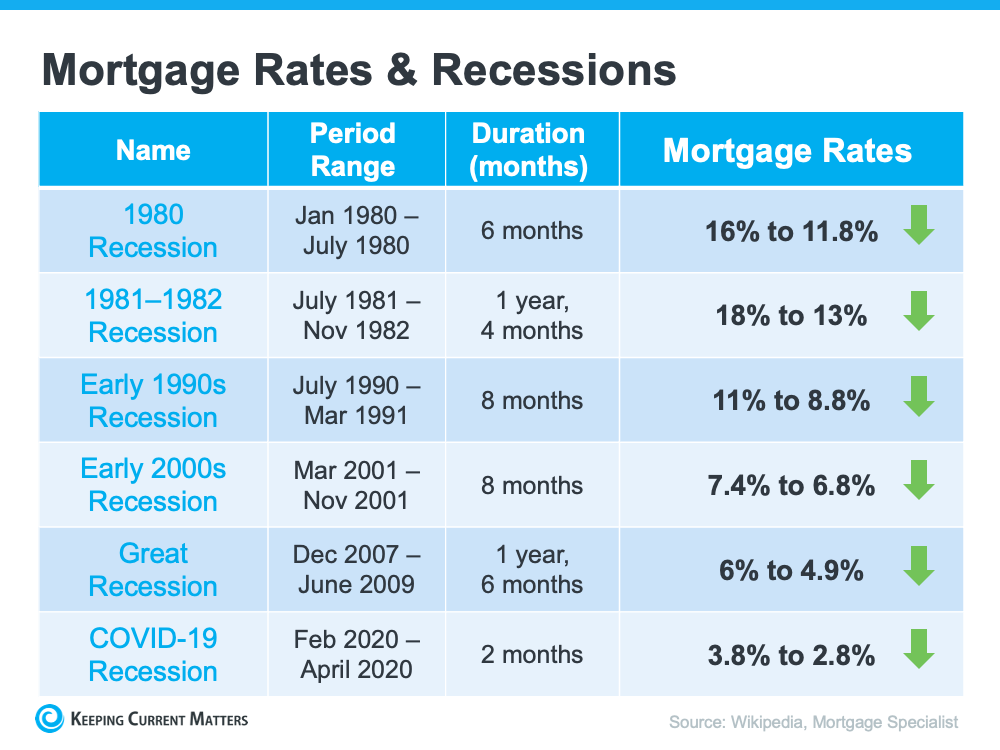

Here’s the data to back that up. If you look back at each recession

going all the way to the early 1980s, here’s what happened to mortgage

rates during those times (see chart below):

As the chart shows, historically, each time the economy slowed down, mortgage rates decreased. Fortune.com helps explain the trend like this:

“Over the past five recessions, mortgage rates have

fallen an average of 1.8 percentage points from the peak seen during the

recession to the trough. And in many cases, they continued to fall

after the fact as it takes some time to turn things around even when the

recession is technically over.”

And while history doesn’t always repeat itself, we can learn from it.

While an economic slowdown needs to happen to help taper inflation, it

hasn’t always been a bad thing for the housing market. Typically, it has

meant that the cost to finance a home has gone down, and that’s a good

thing.

Bottom Line

Concerns of a recession are rising. As the economy slows down,

history tells us this would likely mean lower mortgage rates for those

looking to refinance or buy a home. While no one knows exactly what the

future holds, you can make the right decision for you by working with a

trusted real estate professional to get expert advice on what’s

happening in the housing market and what that means for your

homeownership goals.

Source: KeepingCurrentMatters

Leave A Comment